READ THIS

First of all, before you start thinking about investing, you should be debt free. The reason? The average investor might only be able to earn 5%-6% per annum but the cost of interest is usually higher than this. (And this is if you invest correctly). If you have credit card debt (~24% interest rates?!), pay those off first.

SETTING EXPECTATIONS CORRECTLY

Wait. Before all those gasps of collective surprises, 5%-6% of returns only? My friend, you read it correctly.

While some of you might snob away at this paltry amount, do note that it is the averaged return over multiple market cycles; i.e periods of bear markets and terrible returns. In addition, I’m adding on a 2% p.a discount because humans are on average terrible investors. We tend to buy high and sell low. Look at all those advocates for passive investing right now when the market is at all time highs. Did you see any of this when the market was at the 2008 lows?

While all of us might think that we are above average, the truth is; this is like university, even if you went in as a straight A student, somebody has to take the Cs and Ds. Not everybody can be above average and you are essentially competing in the same market as the top investment professionals in the world. The game is tough.

COMPOUNDING IS MAGIC

So what if it’s just 5% or 6%?

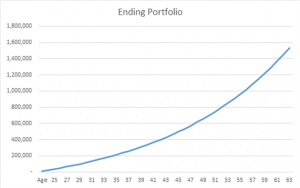

Well. If you contributed $1000 a month from the age of 24 onwards, by the time you hit 60, even on a 5% return you would have 1.5 million

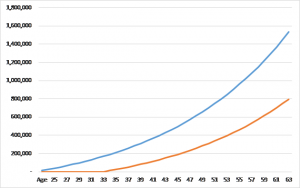

What if you started later at say 35 years old? How would that look like?

Essentially, by starting just 10 years later (which is pretty short in the 40-year investment horizon) your ending portfolio is half of what it could be.

KEEPING COSTS LOW

Most investment plans in Singapore charge huge amounts of fees while underperforming the market. To me, this is really the fastest road to being pok gai.

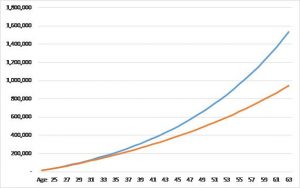

In the same case above, we invest $1000 every month. However, we are charged a 2% annual management fee.

Look at that!

MOST STOCKS ARE LOSERS

Yep. You read it correctly. Most stocks lose value and by buying them you lose value. Look at the top stocks 30 years ago, you had names like Kodak, Xerox. Where are they now?

Moreover, stock returns also exhibit a fat tail characteristic. There are a few stocks that win and they win BIG. (or bigly if you are Trump…)

If you miss these stocks your returns are highly likely to be below average.

Peter Lynch terms this as his “ten-baggers”. However, let’s be honest; you are highly unlike to be able to be exactly able to pick these stocks while avoiding the bad ones. Would you have been able to avoid companies like Enron while simultaneously picking companies like Google or Apple?

YOUR LIKELIHOOD OF OUT-PERFORMANCE IS LOW

Most money managers fail to outperform the index. The likelihood that an individual is able to do so is extremely low.

Also, unless you have more than a million dollars (in which, please disregard any advice from me because odds are, you are probably more well informed than me), there is little value in out-performance.

Let’s say that you manage to outperform the index by 200 basis points (on the same level of risk which is impressive), your net gain on 1 million is only… 20,000.

What is the effort required for that? Top money managers pore through vast amounts of reading material on a daily basis with an army of analysts to help them in their hunt for alpha.

20,000 for so much effort. You would be better off driving an uber on the weekends or concentrating more at work.

The effort to reward ratio does not make sense.

CONCLUSION

From reading this article, you should understand these few things

- Investment returns on average are going to be about 5% – 6% on a nicely well-diversified portfolio. Anyone promising sky-high returns either requires you to take an inordinate amount of risk or are charlatans. Because, if it was so good, why would they offer you instead of hogging it themselves?

- Start investing early because time matters

- Don’t pay for sub-par performance

- Stock picking is very very hard

- Be diversified

- Forget about outperforming the index

In the next article, I will talk about how you can obtain the performance of the S&P500 or any other stock indexes at a cheap cost (Hint, it’s called ETF)