ETFs

Simply put, ETFs are one of the best instruments that are available to investors today; especially for retail investors like you and me.

If I were to give an analogy, ETFs are like “cai png” – Cheap and gets the job done whereas your traditional mutual funds are like “restaurants” – Expensive and sometimes cui.

vs

After this article, you will be able to understand the following

- What is an ETF exactly?

- Why is it so good?

- What ETFs are there out there?

We will not be covering portfolio construction in this article as that is too complex and would require a separate article for itself to do justice to it.

WHAT IS AN ETF?

ETFs is an acronym for its rather unsexy and uninspiring name: Exchange Traded Funds. The name originates perhaps for its unique feature that it is actively traded in the markets, much like a stock.

The analogy I would give for an ETF is that, if you think of stocks as eggs, an ETF is a basket containing the eggs and being sold together in a bundle.

Being actively traded brings about many benefits, namely, efficiency as well as liquidity. Before ETFs came to the forefront, if you wanted to buy a diversified portfolio. You had to go through an arduous process that could span weeks (imagine that). You could either buy the individual stocks yourself or buy a fund.

Purchasing it yourself could be a nightmare and if all you had was a few bucks, then it could prove to be almost impossible. After all, gaining exposure to 500 stocks when all you have is 500 bucks is not an easy task. (I mean… you can’t really buy 0.0001 share of APPL right?)

If you bought a fund, you had no idea about how the fund was doing except when the manager sent you their quarterly or annual reports.

ETFs have transformed that. Now, you can get a rather efficient price for your holdings at almost any time.

WHY ARE THEY SO GOOD?

We have covered some of the benefits of ETFs already above, however there are other benefits as well which makes it one of my favourite instruments.

- Low Fees

Traditional funds charge a huge premium on their management fees, while studies have conclusively shown that most of them don’t even add value. Unit trusts are one of the biggest offenders with their enormous front and back loads (which can be as much as 5%). In the previous article (link) we have already uncovered how high fees can have a drastic impact on your investment performance. The lower the fees, the better. ETFs excel in this aspect with most of them charging fees of less than 0.2%.

- Diversification

You would have also learnt that diversification stabilizes returns and is probably the only free lunch in obtaining risk adjusted returns. ETFs provides a cheap and easy way to obtain such benefits. If you were looking at the small cap US stocks, imagine the tedious amount of effort in going out and buying them in the right proportions.

- Ease of obtaining exposure to illiquid asset classes

While most of us will only be familiar with equities, the truth is; equities is one of the smallest asset classes out there. Other asset classes such as currencies, fixed income (rates and credit), alternatives (commodities) are also essential in the investing journey. Diversification does not stop within the asset class, rather it should encompass your entire portfolio. ETFs allows one to gain exposure to these asset classes at a cost effective and manageable level. Imagine you wanted to invest specifically in property sectors with just $2000, that would have been impossible in the past, but with ETFs it is realizable now.

To summarize, ETFs are low cost, provides inbuilt diversification and allows one to gain exposure to asset classes that one might not have been able before.

WHAT OTHER ETFs ARE THERE?

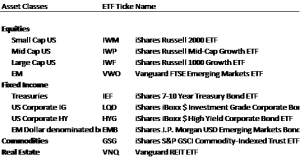

The universe of ETFs is truly large. However, I have included a few below.

SUMMARY

ETFs offer one the ability to construct a meaningful investment portfolio per your own risk and return preferences. We will cover portfolio construction and its mechanics in the next article.

Bonus: You can do it yourself now and gain wayyyy better returns than those ILPs that financial agents are constantly trying to sell you.

Bonus Bonus tip: If any “financial advisors” pester you about ILPs, just tell them that you invest through ETFs, it works almost as good as telling them i’m a student.